It was always apparent, from the very earliest discussions of what to control Covid-19 in New Zealand, that the economy would be the biggest casualty. The NZ finance minister, the Hon. Grant Robertson, commented at the time that “A recession in New Zealand is now almost certain and will affect every part of the economy for some time.”

Now, whilst the coronavirus has been eliminated in NZ to all intents and purposes thanks to going hard and going early, the subsequent recession has indeed arrived, especially in the most affected sectors such as hospitality and tourism.

For many, business as usual simply isn’t possible, in an environment where New Zealand is off limits to the world and where too many people have lost their jobs or are facing financial hardships.

If your business has been affected, you need to reconsider what you’ve been doing and instead review what you might do to reinvent your business to suit the changed conditions.

To help you through the process, we’ve put together a rigourous online training course covering the key elements that you need to consider, and the action steps that you need to take, to enable you to survive and thrive in tomorrow’s business environment.

The course consists of eight lessons:

Lesson One: Take Stock of Your Situation

The number one issue confronting Kiwis today: the economy. That’s hardly surprising, after two months of business-destroying lockdown, but we’ve also been provided with independent confirmation from Ipsos: 47% of New Zealanders expressed concern about the economy in the latest Ipsos New Zealand Issues Monitor, up from just 13% in March 2020.

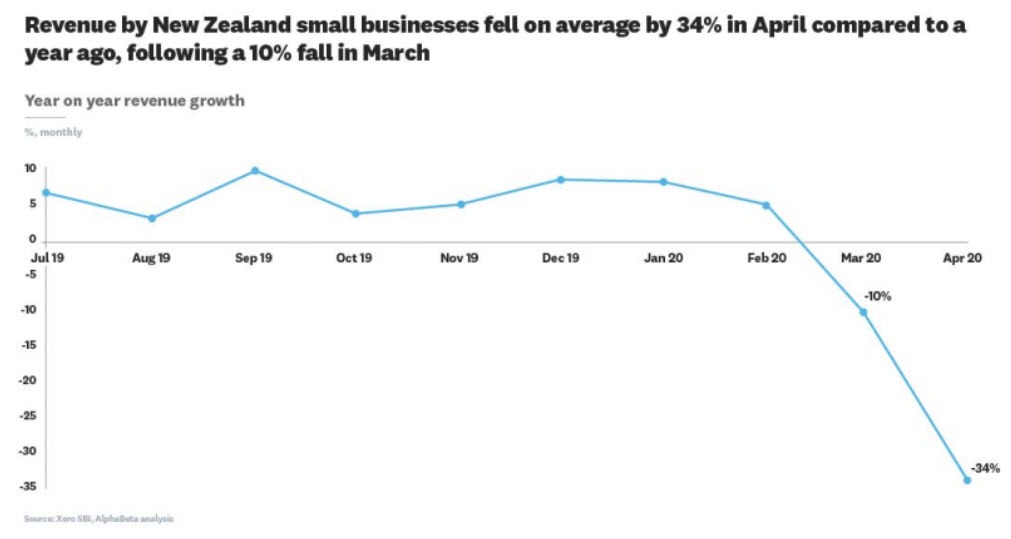

And Xero data from March and April 2020 shows (unsurprising) significant small business revenue declines whilst NZ was in the midst of its Level 4 lockdown:

So what happens now?

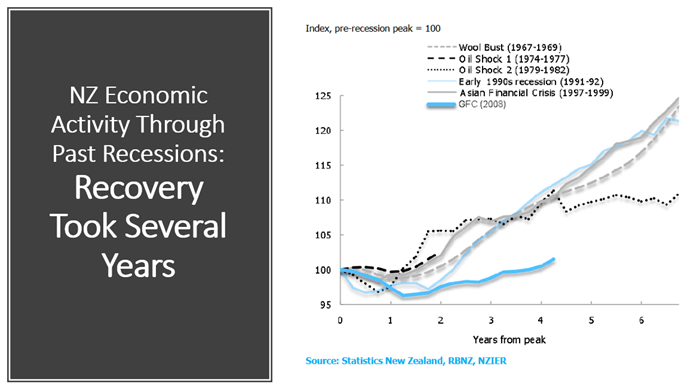

Will we stagger along at the mercy of external circumstances, taking several years to drag ourselves back to some semblance of where we were at the beginning of 2020? Last time, it took four years to get back to where we had been:

Or can we reinvent ourselves in response to the Covid-19 pandemic?

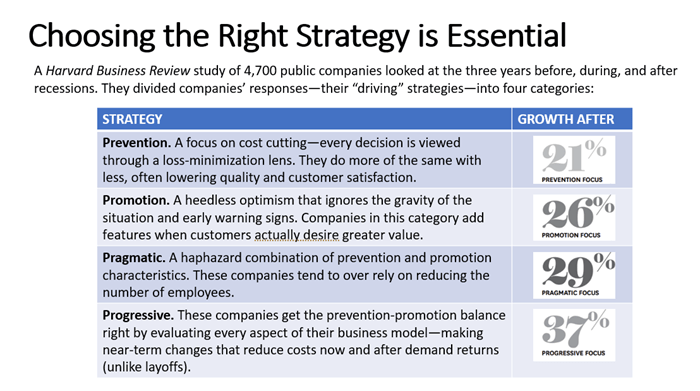

In 2010, Harvard Business Review looked at which U.S. businesses weathered the 2007 recession, and which crumbled and were left behind. 80% of companies that survived were slow to recover, and half of those still had not returned to pre-recession sales or profits during the time period studied. But 9% of the sample actually flourished and outperformed their rivals. (Source: Inc.com)

At the heart of this success: choosing the appropriate strategy.

In this lesson, we encourage you to understand the true impact of the recession on your business. We step you through the processes that will enable you to:

- Examine the fundamentals of your business and your industry sector

- Evaluate the “new normal” marketplace that’s expected to dominate for the next few years

- Gather information on your competitors and how they are reacting to changed market conditions

Then we help you plot a path that takes advantage of these findings.

Lesson Two: How will your customers behave?

An even more important issue to consider in the new marketplace: how will your customers and prospects behave?

In these times, research tells us that four Psychological Segments will dominate:

Segment 1: Slam on the Brakes

The hardest-hit consumer segment, which may reduce, delay, or eliminate spending. It includes lower-income buyers and high-anxiety buyers of all wealth levels.

Segment 2: Pained but Patient

The segment with near-term anxiety but a positive long-term outlook. This is often the largest segment. Buyers economize across all areas. More bad news may push them into the slam-on-the-brakes segment.

Segment 3: Comfortably well-off

The segment that continues buying at almost the same level, with some additional selectivity about purchases. It’s made up mostly of wealthy consumers.

Segment 4: Live for Today

A segment that skews young and urban, with a focus on experiences over stuff. They are generally unconcerned about savings, though they may delay major purchases.

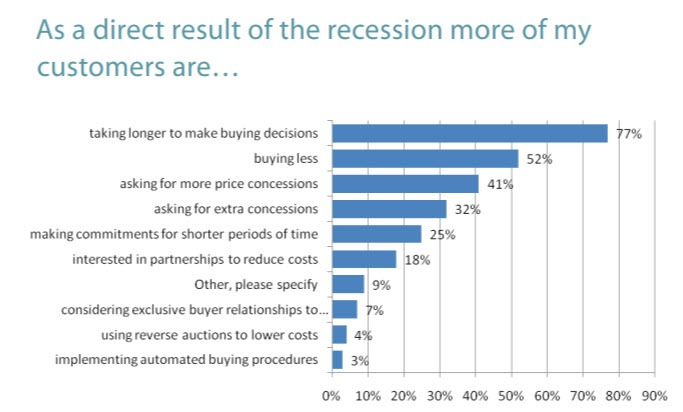

Buying Decisions Take Longer

You should also expect buying decisions to take longer, as a recent Oracle research study reports:

In this lesson, we discuss how different customer segments behave in response to recessionary pressures, and recommend appropriate strategies and tactics for each segment.

Lesson Three: Don’t Waste a Good Crisis

How can we take heed of the advice from (amongst others) Sir Winston Churchill and Sir John Key, “don’t waste a good crisis” ?

What these esteemed gentlemen mean is that crises such as these represent a unique opportunity to reinvent your business more effectively for the future.

As PwC Indonesia notes: “When resources are limited it is critically important to be aware of the profitability of individual customers and products. Profitable customers and products need and deserve investment – not least because they will be at risk of loss to competitors – whilst unprofitable customers and products require detailed analysis to determine whether or not the position can be rectified. It makes no sense to have scarce resources, in the form of financial investment or management time, tied up in delivering products or services at nil or negligible profit unless a rapid improvement can be achieved.

“Cost control is a necessary obsession for any business. In good times however, it is frequently subordinated to the imperatives of growth and development. In a recession, cost control and cost reduction must be a prime focus of management who should start with a blank sheet.”

In this lesson, we will help you to identify your unprofitable activities and make the necessary adjustments, to ensure that you focus your attention on your most profitable pursuits.

In particular, we’ll talk about how you can:

- Prune the Dead Wood

- Reduce Your Internal Costs

- Improve External Costs

- Evaluate (and Learn From) Your Competitors

Lesson Four: Listen

It’s never been more important for businesses to listen to what consumers are saying, typically through social media, about their circumstances, their opinions and their feedback especially on products and services in your industry sector.

What should you be listening for? Amongst other things:

- complaints

- compliments

- expressed needs and wants

- what competitors are doing (or not doing)

Customers, prospects and peers are discussing your brand, your industry and your competitors right now in social media, with or without you. Unfortunately, choosing not to listen doesn’t make those conversations go away. Actively listening means protecting brand reputation, discovering opportunities, staying competitive and avoiding runaway crises.

In this recessionary world, expressed needs and wants (“I really wish there was some way of…”) will help you identify opportunities and start to determine unserved consumer demand.

In this lesson, we explore consumer and competitor monitoring, where you should look, how you should look and what you should look for.

Lesson Five: Promote Products/Services That Offer Greatest Customer Benefits

As Ivey Business Journal notes: “In tough times, advertising and marketing expenses – classified as discretionary – are usually among the first to get slashed, even before market research and R&D. The irony is that because so many firms cut their advertising budgets, advertising costs tend to fall during recessions – meaning that the few companies that advertise aggressively get much more attention at a significantly reduced price.

“This increased attention at relatively low cost can be a powerful tool, as US household products company Procter & Gamble found during the Depression. Seeing an opportunity to reach its core customers – then referred to as “housewives” – by advertising on radio, the company launched the first daytime serial radio program in 1933, a genre that became known as “soap operas,” since P&G was advertising soap. Today, when competitors start to spend and try to catch up as better times return, it is either too late or very expensive.”

Customers always want to be shown an attractive return on investment, but when funds are tight, only those solutions with solid benefits and high ROI will be approved.

According to Joe Mertens, president of Sirius Computer Solutions, “Business projects that are specifically geared toward solving problems are the solutions that are more apt to be approved. Other, more general ones will be pushed out further. Discretionary spending is not as likely.”

In this lesson, we discuss the (paid and unpaid) marketing opportunities open to you and how you might leverage them to maximum effect, whilst highlighting key consumer benefits. We also discuss the general trend towards online marketing and how best to take advantage of that trend to establish a strong position in your market.

Lesson Six: Innovate

The best time to go on the offensive with new products and processes is when your competitors are weak. The Ivey Business Journal highlights the success during troubled times of IBM:

“During the Great Depression, business machine production fell precipitously, declining 60 percent from 1929 to 1932. At the time, IBM was a small player in the industry. But CEO Thomas B. Watson was convinced of two things: that the industry had a strong future, and that companies that were cash-strapped would turn to automation for cost savings.

“Instead of cutting back, as most of its competitors did, IBM accelerated the development of a new, state-of-the-art accounting machine, launching it in 1930 (and a scaled-back, less-expensive model a year later). Starting in 1932, IBM committed 6 percent of total revenue to R&D and built America’s first corporate research laboratory. The company also added leasing to its arsenal, in turn adding legions of new customers who needed, but couldn’t afford to purchase machines.

“The investments paid off. During the 1930s, IBM launched three times as many products as it had in the previous decade. These and other Depression-era decisions gave the company a decisive, long-lasting advantage over its competitors. Its revenues doubled between 1928 and 1938, while industry revenues overall declined 2 percent.”

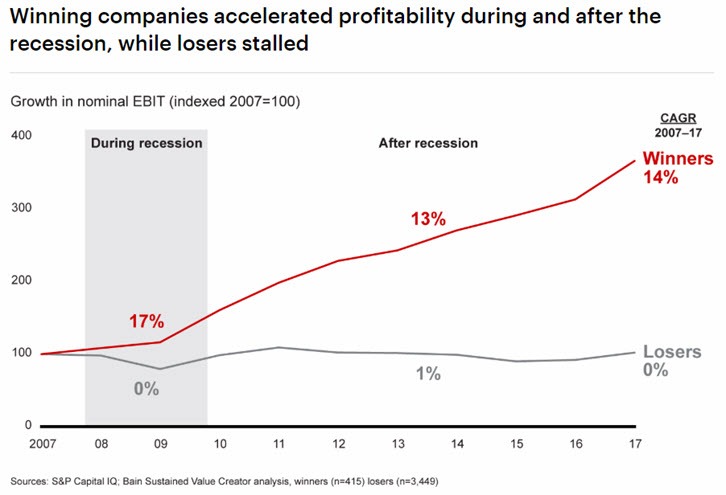

More recent data highlighted by Bain & Company makes a similar point:

During the 2007/8 recession, “while most companies tightened their belts, successful leaders, trading lower short-term profitability for long-term gain, refocused rather than cut spending.”

In this lesson, we explore innovation and inspiration, illustrated with examples of many companies, both locally and globally, that have seized on recessionary times to develop and market innovative products and services.

Lesson Seven: Go Digital (as much as you can)

One of the surprising lessons from the coronavirus, even though we’ve seen it in the statistics for years, is the many different ways in which digital has transformed both in New Zealand and global economies. Technologies such as Zoom made it almost painless to work from home and have instant meetings with co-workers and clients. Companies that had transitioned their files to full digitised records had little difficulty accessing their information during the lockdown.

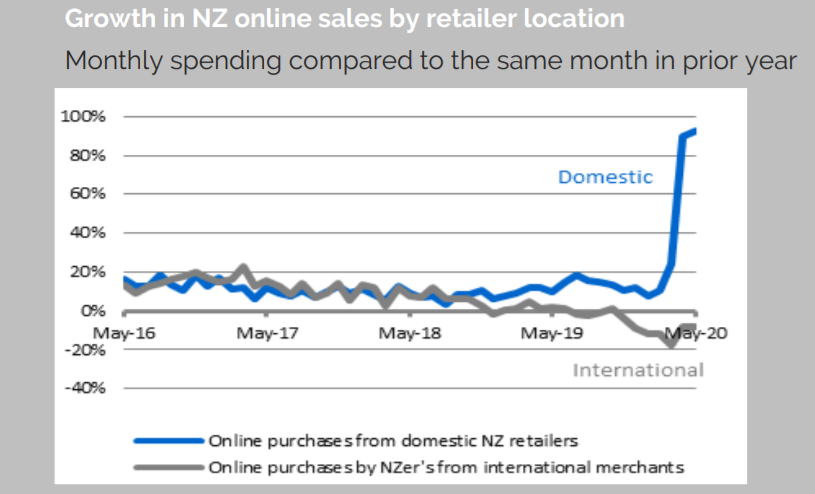

Consumers likewise were easily and rapidly able to transition to buying online, as BNZ Marketview data demonstrates:

What quickly became apparent, however, was that the underlying logistics infrastructure (at least in the earliest stages) wasn’t equipped to handle the sudden increases in volume. “Click and Collect” demand suddenly grew well beyond the ability of supermarkets to handle much more than their existing consumer base; and courier services were taxed well beyond their inherent capabilities.

In this lesson we help you to evaluate where best to apply digital transformation to your organisation, what systems and processes to prioritise, what bottlenecks will inevitably arise and where to turn for expert assistance.

Lesson Eight: Growth-Hack

You may be unfamiliar with the term “growth-hack”. It’s a neologism that has arisen in recent times to describe business activities designed to dramatically accelerate growth.

The definition of growth-hacking isn’t easy to nail down, but (per Crazyegg) growth-hacking means rapidly experimenting with different marketing tactics, advertising efforts, web design decisions, and other tasks to quickly convert leads and generate sales.

Companies such as Airbnb, PayPal and Dropbox are amongst some of the most conspicuous examples of successful growth-hacking in action.

In the current economic climate, accelerated success through growth-hacking is almost mandatory. In this lesson, we explore a wide range of examples of growth-hacking in practice, and identify key strategies to help you magnify the success of your efforts, shamelessly borrowing ideas from some of the world’s leading exploiters of growth-hacking.

Conclusion

Business post-Covid-19 can’t be the same. Don’t get stuck clinging to the patterns of the past, it’s time to seriously reinvent your business for a new and more profitable future.

—

TIMING

This course begins on Thursday 18 December, 2025.

INVESTMENT

This eight-part online training course is available for $797+GST. However we offer a $100 Early Bird Discount for bookings received and payment made by midnight on Thursday 11 December, 2025. Pay only $697+GST for this course!

Bookings are confirmed on receipt of payment, which can be by bank deposit or credit card. We can raise an invoice in advance if you need it.

To reserve your place in this course, please pay by credit card through PayPal by clicking here.

If you would prefer to pay by bank deposit, or require an invoice before making payment, please send an email to info@socialmedia.org.nz with details of your request.

(The service provider will be shown as Netmarketing Courses in your transaction and on your credit card statement).

WHAT HAPPENS NEXT?

Your booking will be confirmed by email (if you have not received a confirmation within 24 hours, feel free to email info@socialmedia.org.nz).

On the first day of the course you will be supplied by email with login details and Course Notes for Lesson One.

About Us

The course has been created by Michael Carney, longtime marketer and author of the top-selling book “Trade Me Success Secrets” (now in its Second Edition) which tells how to sell effectively on this country’s largest and most successful eCommerce platform. Michael is also the creator of a number of other online courses and consults on many digital business initiatives.

This is an online course, conducted on a web-based e-learning software platform, enabling course participants to proceed at their own pace, accessing materials online. This particular eCourse provides content in a variety of multimedia forms, including videos, slideshows, flash-based presentations and PDF files. No special software is required to participate.

Course lessons are provided via web browser, for participants to access in accordance with their own timetables.

Customer Feedback

Here’s what some of our students have said about our online training courses:

- Really informative course, definitely helping us whilst we start out on our first ecomm project in NZ — Rob. T

- Thanks for another great course. I found it insightful, in-depth and I know our web presence and web sales will improve because of it. — Bruce H.

- I have somehow managed to develop over 80 pages of my own notes to complement the course ones. I look forward to participating in another in the near future. — Mark J